By

Charles Hall

|

Auditing

In this post, you’ll gain an understanding of unmodified and modified audit opinions using the guidance from AU-C Section 700, Forming an Opinion and Reporting on Financial Statements and AU-C 705, Modifications to the Opinion in the Independent Auditor’s Report. SAS 134 (and other SASs) amended these sections resulting in new audit opinions for periods ending after December 15, 2021.

There are four potential audit opinions:

- Unmodified

- Qualified

- Disclaimer

- Adverse

Video Overview of Audit Opinions

This video provides an overview of the four opinions:

1. Unmodified Opinion

If there are no material misstatements, then you will issue an unmodified opinion. The unmodified opinion says the financial statements are presented fairly.

Example SAS 134 Unmodified Opinion

A sample unmodified audit opinion follows:

[Date]

INDEPENDENT AUDITOR’S REPORT

[Appropriate Addressee]

[Entity Name]

Opinion

We have audited the financial statements of [Entity Name], which comprise the balance sheets as of December 31, 2020 and 2019, and the related statements of income, changes in stockholders’ equity, and cash flows for the years then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of [Entity Name] as of December 31, 2020 and 2019, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of [Entity Name] and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about [Entity Name]’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

-

- Exercise professional judgment and maintain professional skepticism throughout the audit.

- Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements.

- Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of [Entity Name]’s internal control. Accordingly, no such opinion is expressed.

- Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements.

- Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about [Entity Name]’s ability to continue as a going concern for a reasonable period of time.

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

Firm Signature

Modified Opinions

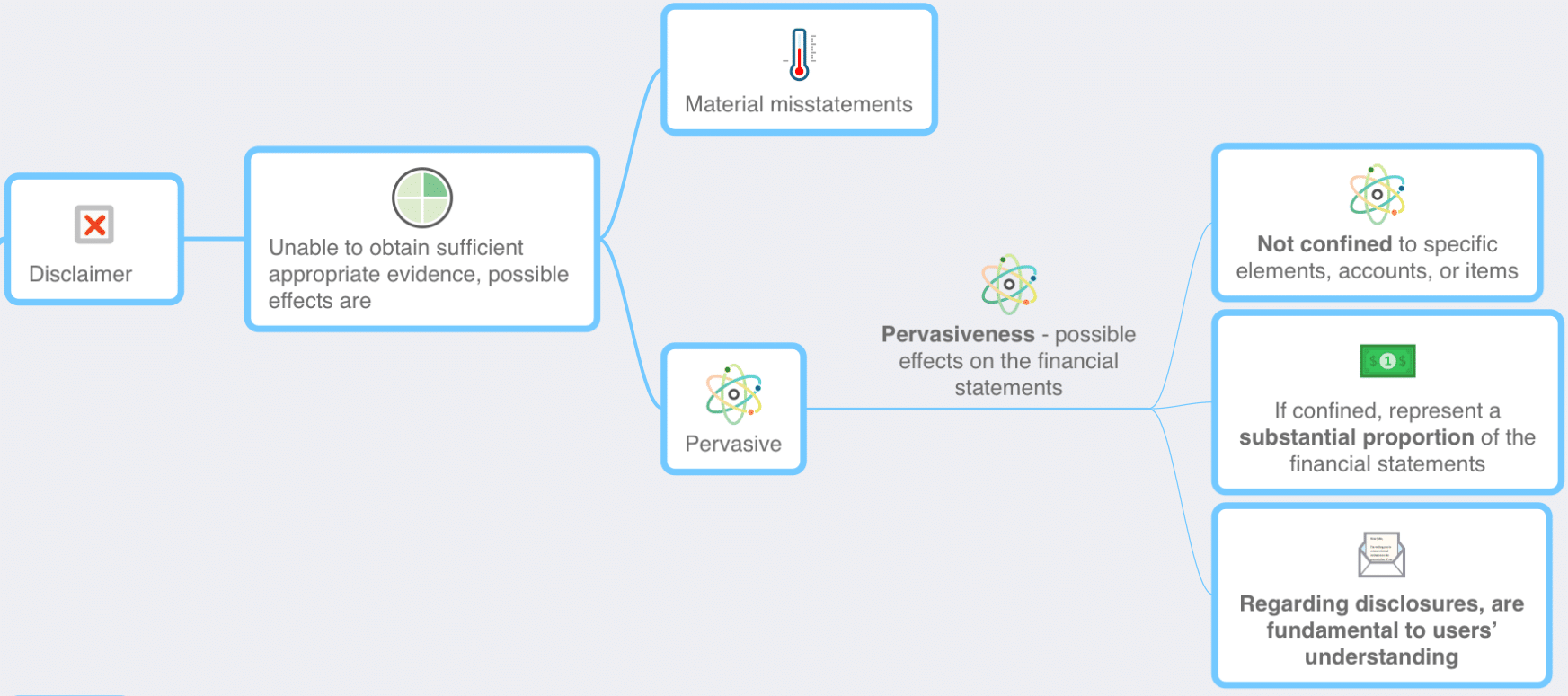

If material misstatements are present, then a modified audit opinion is necessary. Modifications can also occur when you are unable to obtain sufficient appropriate audit evidence; for instance, when a scope limitation is present.

Definitions

AU-C 705 defines a modified opinion as a (1) qualified opinion, (2) an adverse opinion, or (3) a disclaimer of opinion.

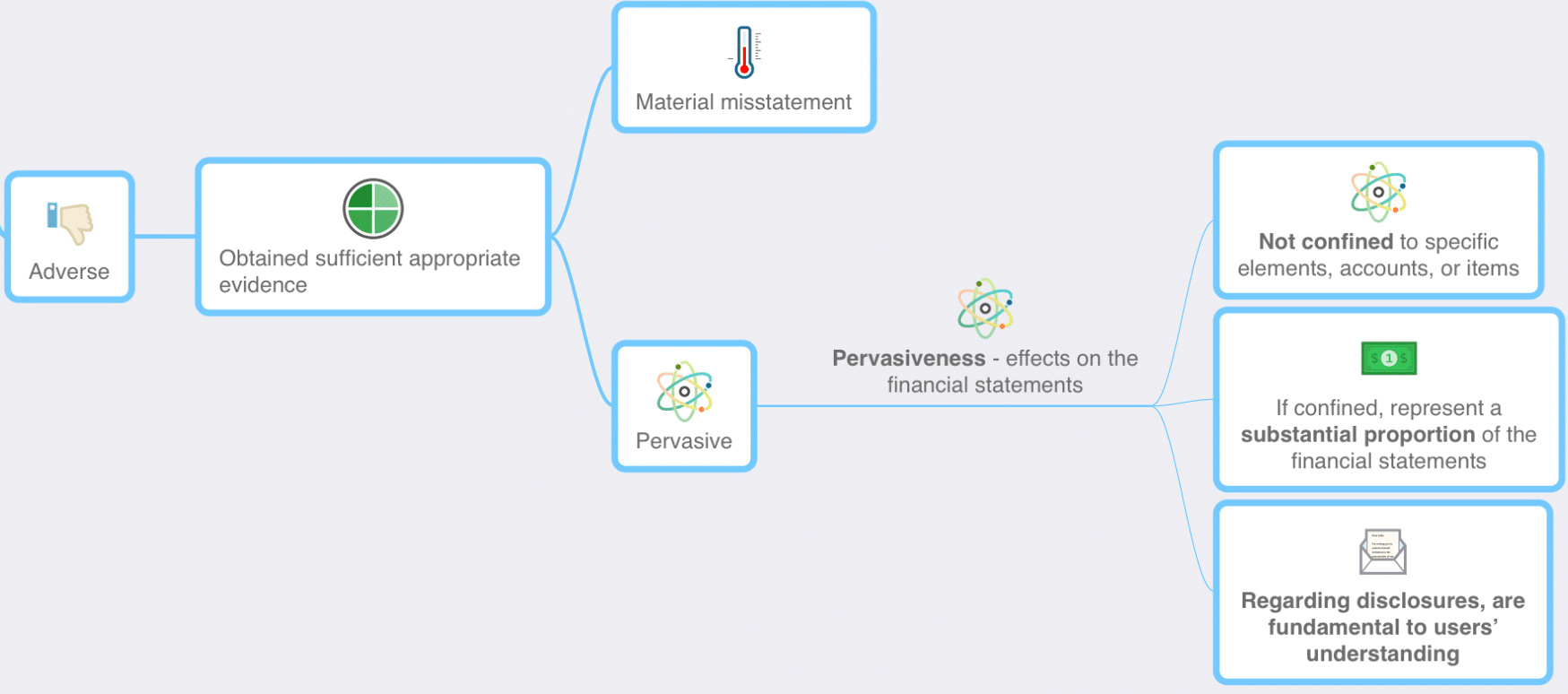

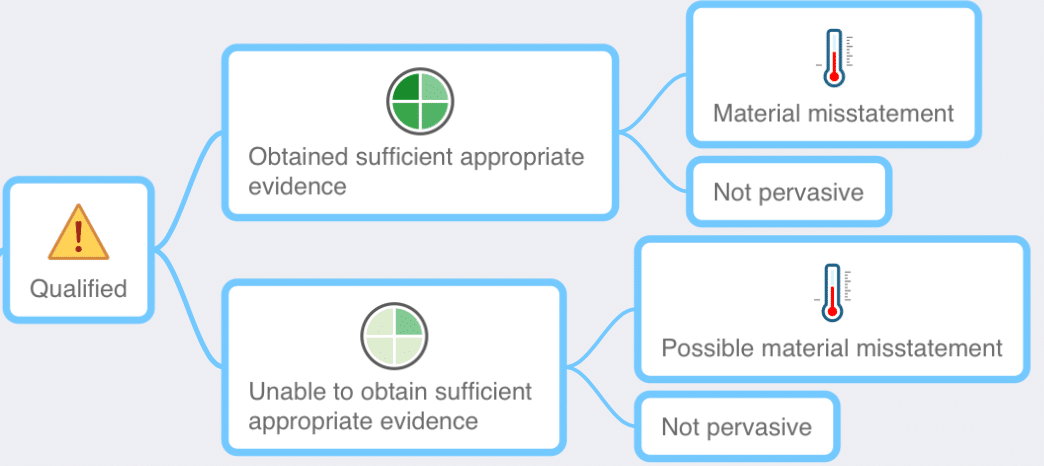

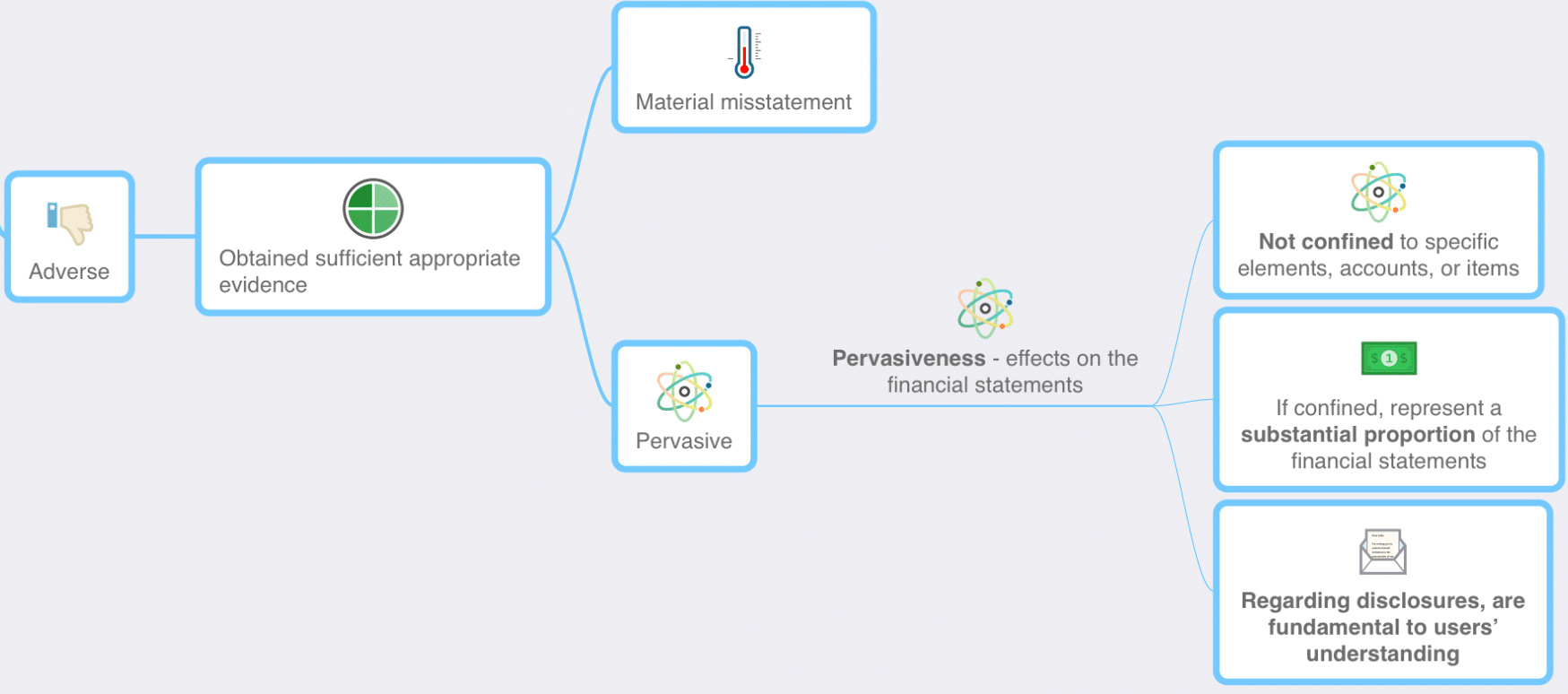

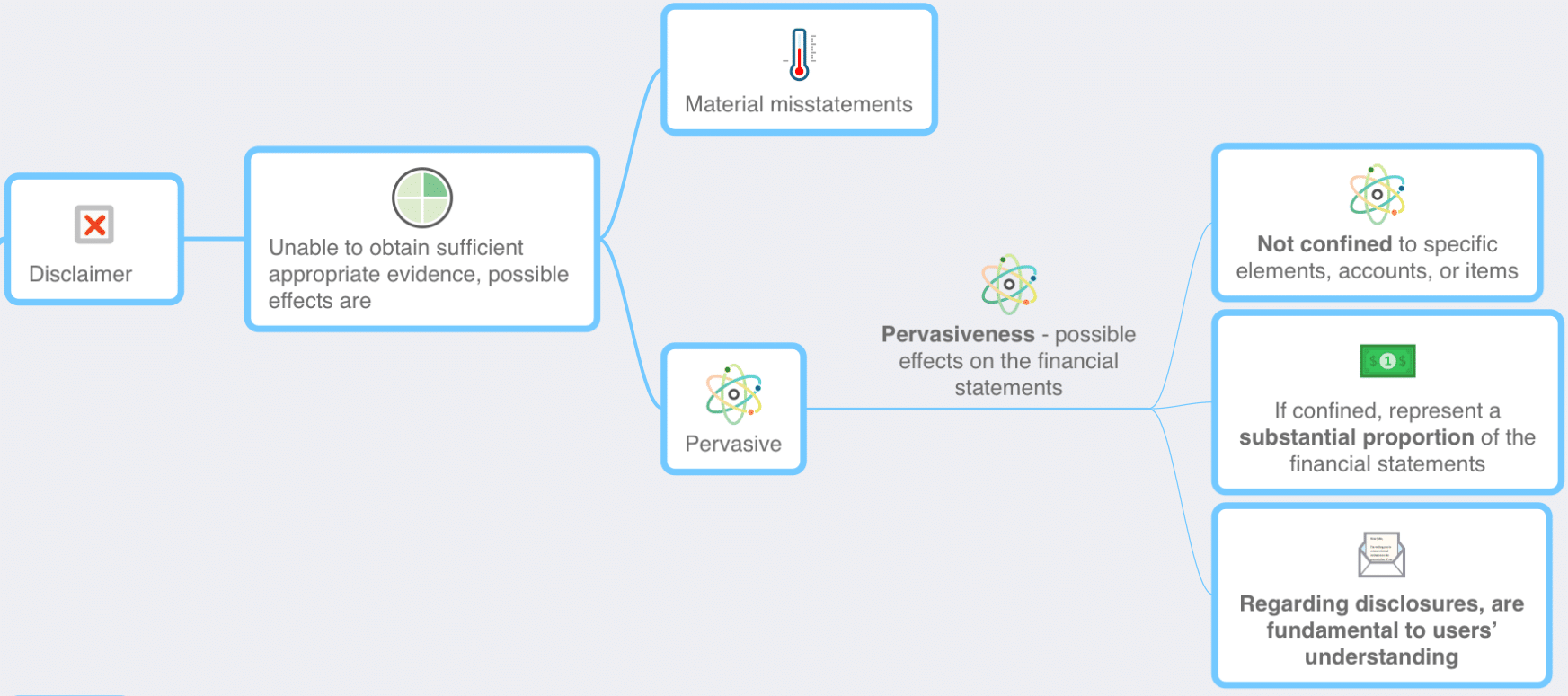

Another key definition in AU-C 705 is that of pervasiveness. This term is used in the context of misstatements; so if a material misstatements are present, you’ll want to know if they are pervasive. Two factors–material misstatements and pervasiveness–affect the type of opinion to be issued. Additionally, the ability or inability to obtain sufficient appropriate audit evidence affects the type of opinion to be issued. A misstatement (or possible misstatement) is pervasive if:

- It’s not confined to specific accounts or items of the financial statement, or

- If confined, the amount represents a substantial portion of the financial statements, or

- If in relation to disclosures, the information is fundamental to the users’ understanding of the financial statements

For example, if material misstatements are present for inventory, receivables, and debt, they are pervasive. Or if, in another example, inventory makes up 60% of total assets and a material misstatement is present in that area, then it’s pervasive. Lastly, if key disclosures are not appropriately communicated or if they are omitted, then that is pervasive.

Now, let’s look at the three modified opinions: (1) qualified, (2) adverse, and (3) disclaimer.

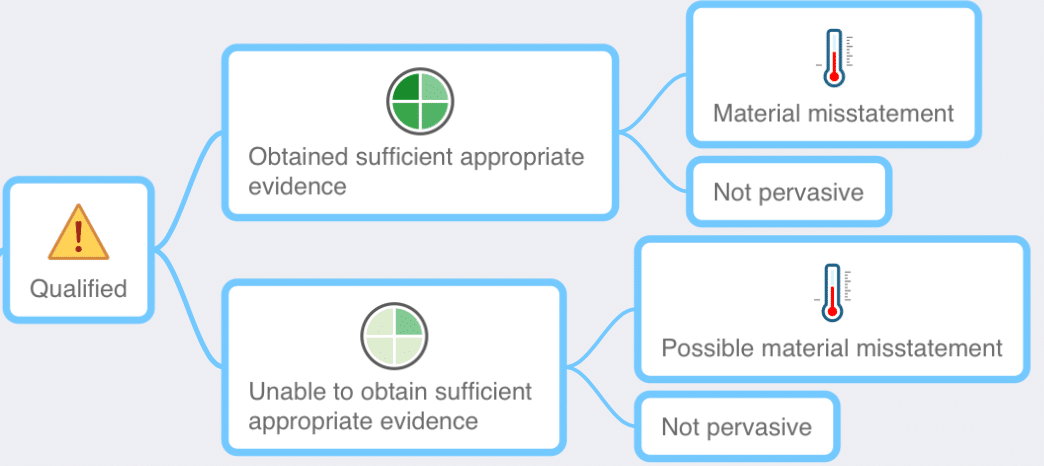

2. Qualified Opinion

Suppose your audit reveals inventories are materially misstated, the client does not record your proposed audit adjustment, and there are no other material misstatements. If this is your situation (a material misstatement exists that is not pervasive), then audit standards allow for the issuance of a qualified opinion.

Here is sample qualified opinion language (this is not the full opinion):

Qualified Opinion

We have audited the financial statements of ABC Company, which comprise the balance sheets as of December 31, 20X1 and 20X0, and the related statements of income, changes in stockholders’ equity, and cash flows for the years then ended, and the related notes to the financial statements.

In our opinion, except for the effects of the matter described in the Basis for Qualified Opinion section of our report, the accompanying financial statements present fairly, in all material respects, the financial position of ABC Company as of December 31, 20X1 and 20X0, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Qualified Opinion

The Company has property with impaired value. The impairment occurred in 20X9. Accounting principles generally accepted in the United States of America require that impaired assets be written down to their fair market value. The Company continues to reflect the property at cost. If the property was stated at fair value upon impairment, total assets and stockholder’s equity would have been reduced by $X,XXX,XXX as of December 31, 20X1 and 20X0, respectively.

3. Adverse Opinion

Now let’s suppose that you are auditing a consolidated entity, and your client is not willing to include a material subsidiary and which, if included, would have a pervasive impact on the statements.

Here is sample adverse opinion language (this is not the full opinion):

Adverse Opinion

We have audited the consolidated financial statements of ABC Company and its subsidiaries, which comprise the consolidated balance sheet as of December 31, 20X1, and the related consolidated statements of income, changes in stockholders’ equity, and cash flows for the year then ended, and the related notes to the financial statements.

In our opinion, because of the significance of the matter discussed in the Basis for Adverse Opinion section of our report, the accompanying consolidated financial statements do not present fairly the financial position of ABC Company and its subsidiaries as of December 31, 20X1, or the results of their operations or their cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Adverse Opinion

As described in Note X, The Golfing Company has not consolidated the financial statements of its subsidiary Easy-Go Company that it acquired during 20X1. This investment is accounted for on a cost basis by The Golfing Company. Under accounting principles generally accepted in the United States of America, the subsidiary should have been consolidated. Had Easy-Go Company been consolidated, many elements in the accompanying consolidated financial statements would have been materially affected. The effects on the consolidated financial statements of the failure to consolidate have not been determined.

4. Disclaimer of Opinion

Finally, let’s suppose you are performing an audit in which insufficient audit information is provided with regard to receivables and inventories (both of which are material) and that the misstatements have a pervasive impact on the financial statements as a whole.

Here is sample disclaimer of opinion language (this is not the full opinion):

Disclaimer of Opinion

We were engaged to audit the financial statements of ABC Company, which comprise the balance sheet as of December 31, 20X1, and the related statements of income, changes in stockholders’ equity, and cash flows for the year then ended, and the related notes to the financial statements.

We do not express an opinion on the accompanying financial statements of ABC Company. Because of the significance of the matters described in the Basis for Disclaimer of Opinion section of our report, we have not been able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on these financial statements.

Basis for Disclaimer of Opinion

The Company’s accounting system was hacked during the year by an unknown party, resulting in a series of changes in accounting entries. Additionally, the Company was unable to restore the accounting system. As a result of these matters, we were unable to determine the adjustments that were necessary to correct the balance sheet, statement of income, changes in stockholder’s equity, and cash flow statement as of and for the year ended December 31, 20X1.

Effective Date of SAS 134

The new SAS 134 opinions are required for periods ending on or after December 15, 2021.

Resolving Conflict with Clients

If, as described above, you have a client that is unwilling to post a material audit adjustment, consider creating a draft of the opinion and providing it to them. This is not a threat, just a way to clearly communicate the effect of not posting the adjustment.

Before doing anything, allow the client to fully explain their position. A modified opinion may not be necessary once you understand the facts. But if after the discussion, the you are still convinced there is a material misstatement, a modified opinion may be necessary.

In some cases, you may want to consider withdrawing from the engagement. Consult with your legal counsel before doing so.

Audit Opinion Research

Deciding on the opinion is often the most important decision you will make in an audit. So, do your research, and, if needed, consult with others to gain assurance about your decisions. AU-C 705: Modifications to the Opinion in the Independent Auditor’s Report provides several sample opinions; so refer to those as you create any modified opinions including qualified, adverse, or disclaimer. See AU-C 700: Forming an Opinion and Reporting on Financial Statements for information about unmodified opinions.

If you need to add an emphasis of matter or other matter paragraph for issues such as a lack of consistency, see my article.