Online CPA Resources: Free and Paid Options

By Charles Hall | Accounting and Auditing

Are you looking for online CPA resources? You’ve come to the right place.

There are plenty of online resources, including audit standards, compilation and review standards, illustrative reports, and fraud prevention information. The AICPA’s audit quality centers also offer resources. Some of them are free, while others require a fee.

Online CPA Resources

Here’s a list of online CPA resources that I commonly use (some AICPA documents require an AICPA membership):

- AICPA Technical Hotline

- Ask technical accounting and auditing questions

- AICPA Plain English Guide to Independence

- Get answers to independence questions

- AICPA Quality Management System Practice Aid

- Build your new quality management system

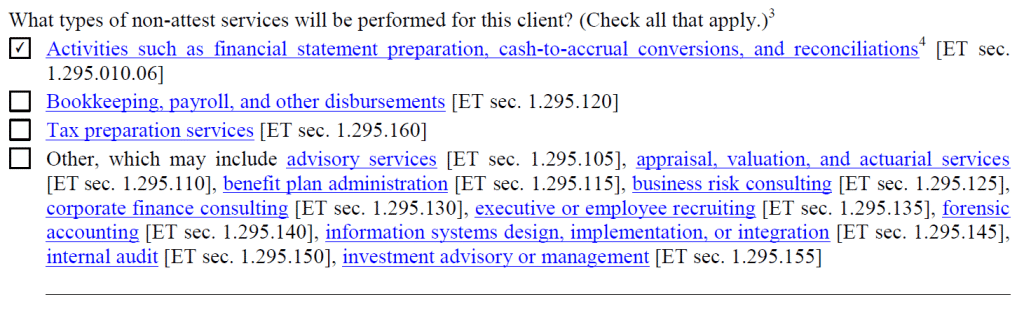

- AICPA Code of Conduct

- Explore ethical and independence issues

- AICPA Illustrative Compilation Reports

- Obtain compilation report examples

- AICPA Illustrative Accountant’s Review Reports

- Obtain review report examples

- AICPA Journal of Accountancy

- Access current accounting and auditing issues

- AICPA SASs (audit standards)

- Obtain audit standards

- AICPA SSARS (compilation and review standards)

- Obtain preparation, compilation, and review standards

- LinkedIn Governmental Not-For-Profit Group

- Join other nonprofit accountants in discussions (free)

- LinkedIn Sole Practitioners and CPA Small Firms Group

- Join other sole practitioners and CPAs in discussions (free)

- Best Accounting Software (List of accounting new sites, associations, organizations)

- See current lists of accounting sites and organizations (free)

- FASB Codification

- Use FASB codification (free)

- GASB Pronouncements

- Use GASB codification (free)

- GASB Technical Inquiries

- Make governmental accounting technical inquiries (free)

- 2022 Report to the Nations (Fraud Resource)

- Obtain ACFE fraud survey results (free)

- COSO Internal Control (Executive Summary)

- See COSO internal controls executive summary (free)

- 2023 OMB Compliance Supplement

- Obtain the OMB Compliance Supplement for Single Audits (free)

- OMB Uniform Guidance

- Obtain the Uniform Guidance for Single Audits (free)

- 2024 Online Version of Yellow Book

- Online access to the most current Yellow Book (free)

AICPA Quality Center Resources

While the following are not free, consider joining audit quality centers if you have a concentration in areas such as governments and benefit plans. Once you join a center, you’ll have online access to their information (e.g., newsletters and alerts). In today’s environment, these memberships are vital. I don’t know how anyone can keep up with all the changes in accounting and auditing standards without resources like these.

I have found the AICPA Governmental Audit Quality Center (GAQC) particularly helpful. They provide timely information alerts to keep you abreast of evolving changes such as those related to Yellow Book and Single Audits.

The Employee Benefit Audit Quality Center is also useful. These audit quality centers provide practice aids and CPE classes relevant to governments and benefit plans.

Another great resource (though not free) is the Center for Plain English Accounting (CPEA). The CPEA provides written responses to your technical questions; the AICPA Technical Hotline listed above is free but they don’t provide written responses, only verbal. The CPEA also provides timely articles about accounting and auditing changes, some of the best I have seen. Their quarterly accounting and auditing CPE update is also quite useful.

Your Online Resources

What online resources do you use as a CPA? Leave a comment.